ESG Board Oversight: Here for Long-Term Strategy

Environmental, Social Responsibility and Corporate Governance (ESG) is taking a prominent position on the proxy statements, annual reports, shareholder proposals, and in every board room’s discussion. Of note, the United States is a decade or more behind Europe/the EU in addressing ESG issues. In addition, questions for quarterly earnings calls with Wall Street analysts are almost certain to include ESG in addition to traditional crisis management plans, largely during the COVID-19 pandemic. As one of the board’s primary responsibilities for strategic oversight, it is imperative to include all segments of ESG-Environmental, Social and Governance on the board agenda.

Environmental discussions are resonating by Regulators, Activists, The New Workforce, and Consumers/Public. Now, more than ever, after years of denying climate change, Investor Relations officers and top executives are scrambling to set carbon neutral or net zero emission standards. Finally, President Joseph R. Biden’s EPA Administrator, Michael Reagen and Congress are analyzing the current state of greenhouse gas emissions in the U.S. and rejoining the Paris Accord. Simultaneously, the previously “pending” ESG regulation is well positioned on the SEC Chairman’s agenda and legislative bills are being drafted in Congress to substantially reduce emissions by eliminating coal fired power plants and cleaning up water systems with so-called “Smart Energy” replacements. Environmentalists are also pushing hard and loud for electrification of the transportation system and for the U.S. to end use of fossil fuels, which goes well beyond a carbon neutral or net zero emissions commitment.

Meanwhile, the traditional sustainability reports, along with some newly named “Environmental, Social Responsibilities and Governance reports within the ESG framework, have taken a center position on desks of large institutional investors: Hedge Funds, Pension Funds and other investors with “red ink marks” and questions on environmental compliance and DE&I/Human Capital Management. Block holders and Activist Investors working alongside the Glass Lewis and Vinson & Elkins firms are working around the clock to work with both the companies and institutional investors. Finally, the sustainability accounting standards and global reporting initiative are dusting off previously submitted frameworks and standards with updates to address today’s ESG imperatives.

The U.S. is in a state of ESG momentum in the minds of top executives, board directors, shareholders, and stakeholders. It is paramount for CEOs, executives, and boards to not only develop the strategy, but also incorporate key aspects of ESG into every strategic discussion in tandem with the Enterprise Risk Management portfolio. ESG is fundamentally changing the notion and expanding the definition of Enterprise Risk Management. It is important for the full board and meeting agendas for audit and risk, Compensation, and Nominating and Governance committees to include various aspects of ESG. Examples include DE&I, human capital management/revised flexible work policies in a compensation committee discussions, ethics and compliance along with new diverse board members and board structure in the governance and nominating, and a plethora of key non-financial and financial impacts and especially cyber security and ESG risks for audit and risk. Instead of the annual board strategy session, boards are starting to meet semi-annually to address pressing ESG issues. In fact, ESG seems to be changing the definition of “materiality” from a purely financial one. Companies once could dismiss issues as non-material if they couldn’t quantify the economic impact. Today issues are appearing to become material long before they have a quantifiable impact on the company’s bottom line.

As the evolution of ESG becomes a reality, boards, management, and shareholders are aligning to avoid fines, penalties, and significant reputation impacts. Board oversight continues to evolve around the broad ESG areas with environmental and social topics taking on a stronger position and more prominent role in strategy discussions. However, social responsibility is not well understood. For some boards and companies, it is sometimes considered the “topic of the month” that will lose relevance in a different administration. DE&I, equal opportunity, freedom of association, human rights, and overall human capital management are subjects often viewed as soft skills lacking the quantitative metrics of sales, production, or stock price. However, a significant difference from previous DE&I discussions is that today’s incoming workforce (Millennials and GenZ) is substantially more inclusive and diverse. Baby boomers are exiting the workforce allowing the setup of new standards and policies that better reflect their makeup and their priorities. Beyond climate change, human capital disclosures, diversity equity and inclusion governance play a critical role in ESG. The positioning of federal government and non-financial disclosures are requiring ESG Frameworks, law firms, and audit firms to support corporations and boards in the development of committee charters to monitor material issue risks and performance in respect of health, safety, security, environment climate change and the overall stakeholder expectations.

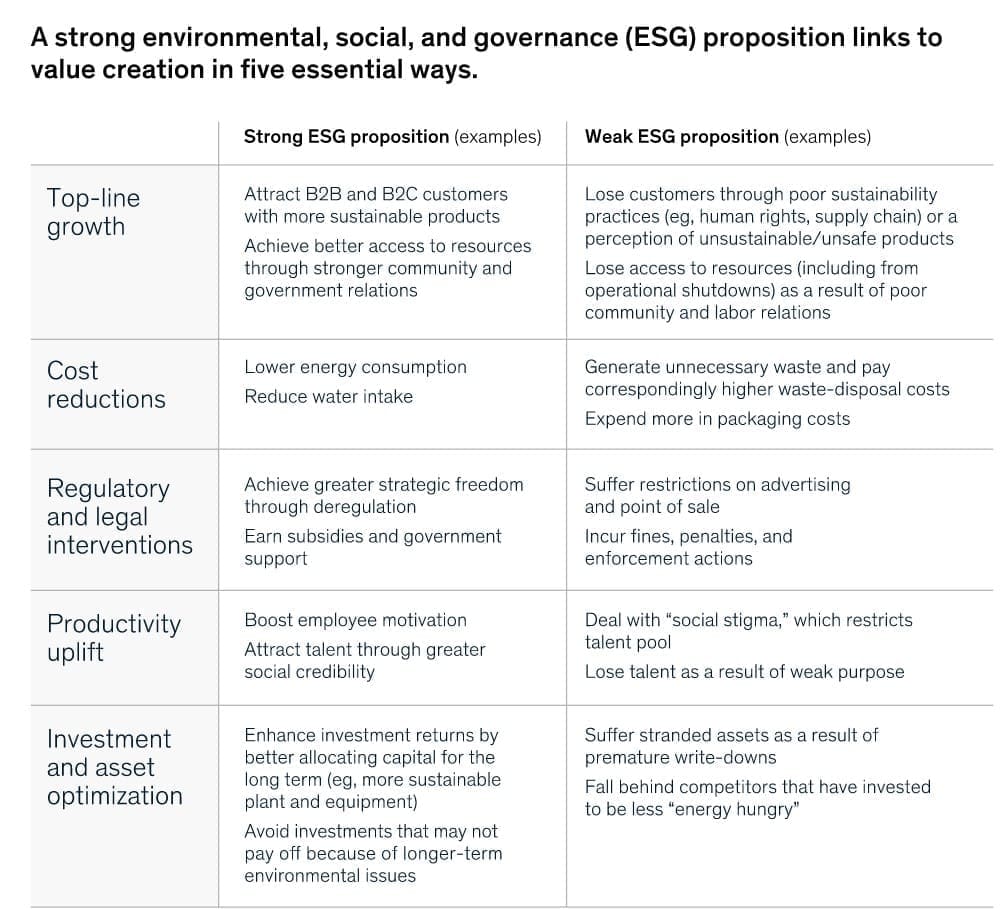

Once defined as an emerging area of board oversight, ESG will eventually become a formal item on the board agenda. Given the direct link between ESG and Risk oversight, boards advising management must spend the time to prepare and educate themselves outside the board room to understand the necessary internal controls, best practices, and overall strategy to avoid significant impacts including successful shareholder proposals to overturn the company’s current strategic approach. As management develops the overall corporate strategy and integrates ESG into its operations, an “all hands on deck” approach is required by all directors to effectively advise/monitor performance, internal controls, crisis communications plans and focus on ESG issues to create long term strategic value. McKinsey & Company’s exhibit below depicts a strong link between core ESG values and value creation for the enterprise.

Directors clearly create long term value for the shareholders, company and strengthens the overall stakeholder strategy. EY’s recent article entitled, “How ESG creates long-term value-Sustainability’s new frontier” says it best, “ESG reduces risk and drives value creation…as it has become an enabler of access to capital”!

As boards integrate ESG strategy discussions into a corporate Enterprise Risk Management system, it is highly recommended to utilize NACD’s top ten questions:

- Have we set compelling sustainability targets and goals that appeal to the marketplace?

- What story are we telling the street?

- Can we integrate our ESG reporting with financial reporting?

- What reporting framework are we using, and why?

- What accountabilities have we set for ESG-related performance?

- Does our ESG reporting satisfy the needs of the investment community and other stakeholders?

- What are our ESG risks, and how well are we managing them?

- What have we done to ensure that our ESG-related disclosures are reliable?

- Does or should our independent auditor have a role in ESG reporting?

- How has the COVID-19 pandemic affected our ESG reporting?

Finally, as ESG issues continue to resonate during the window of opportunity for boards, shareholders and management teams, a clear path of regulations, policies and board best practices are imperative. Likewise, managing and monitoring the associated risks through effective strategy to avoid negative current and future impacts with an “all hands on deck” approach across all stakeholders, determines who will ultimately be successful.

This is supported by:

- With multi-national and EU-based companies, ESG issues are not “flavor of the month.” Individual focus may change (and vary by company and/or industry), but the overall category of concern will only continue to grow in an increasingly interconnected world (such as supply chain issues created by the pandemic, nor buying panics caused by something like the cyber-attack on the Colonial Pipeline).

- Boards need to be front and center in determining what the company’s focus should be and what systems should be put into place to monitor and measure performance. This may point to a need for boards and/or senior management to become more involved in the ESG regulatory policy arena to make certain that rules and regulations are clear and doable.

- ESG is really a governance leading indicator. Issues need to be viewed not only as risks, but as opportunities for competitive advantage, whether innovative production and/or management practices, evaluating the viability of current and future market opportunities, or development of new products and services. The extent to which a board and senior management understand and address ESG issues could well determine whether the company survives or thrives.